Note: The following information is from the CLAIR General Information Handbook and the homepage of the Japan Pension Service . CLAIR is not affiliated with the Japan Pension Service in any way and the information provided here is intended as a reference only. As such, CLAIR and the Saga JET Program assume no responsibility for any damage or losses that occur from the information (or lack thereof) herein.

All JETs can receive a lump-sum payment for a maximum five years worth of payments or, depending on your nationality, they may also be able to transfer the total number of years paid into the Japanese pension system to the equivalent system in their home country. Review the information below, contact the Japan Pension Service for more information, and decide which option is best for you.

Option 1: Lump-sum Withdrawal Payment

Foreign nationals who have been paying Pension Insurance, and who give up residence in Japan, are able to apply for a Lump-sum Withdrawal Payment (pension refund). You have two years to submit the application after departing Japan. In order to be eligible for the Lump-sum Withdrawal Payment, you must fulfil all of the following conditions:

- You do not have Japanese nationality

- Your National Pension Contribution-paid period or Employees’ Pension Insurance Enrollment Period is 6 months or more.

- You do not have an address in Japan.

- You did not receive/were not eligible for pension benefits (including disability allowance)

Before Leaving Japan

Submit your Moving Out Notice (転出届; Tenshutsu-todoke) with your local office/city hall within two weeks of your departure. You can also do this earlier; put down the date of your flight as expected move-out date.

You can also request an updated Certificate of Residence (住民票; Jūminhyō) to prove you will no longer live in Japan, but this is not a necessary document and you will need to pay for this. (Some local bureaus may not permit you to purchase this before your departure date regardless.)

Declare a Tax Representative by filling out a Declaration Naming a Person to Administer the Taxpayer’s Affairs (所得税・消費税の納税管理人の届出書; Shotokuzei / Shōhizei no Nōzei Kanrinin no Todokedesho) and submit to your local tax office. This person needs to be a Japanese resident, but is not required to be a Japanese national. Make sure you trust them with both your personal documents and with your money.

Ensure your Tax Representative has the following information

- Passport Data Paga (with your personal information and photo)

- Residence Certificate / My Number Card (they need your My Number (個人番号; kojin bangō), so if you can share the front and back of the card with your rep they should not need the passport/certificate)

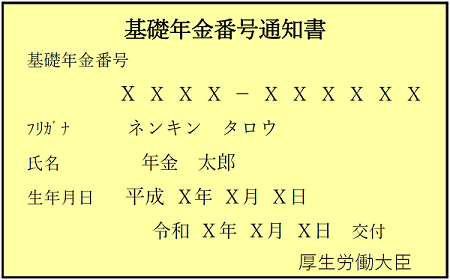

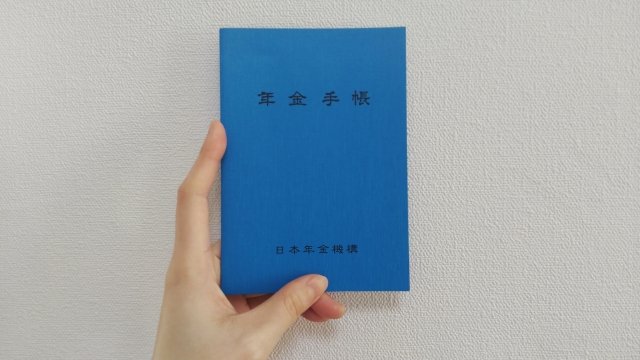

- Either your Blue Pension Book inner cover, or Basic Pension Number Notice (this is not necessary, but may be helpful for them to have your Pension Number)

Ensure that you have the following information:

- Your Tax Representative’s Contact Information

- Contact Information For Your School(s)

- Contact Information For Your Contracting Organization

After Returning to Your Home Country

Note that you can begin this procedure before you return home, but the Pension Office needs to receive your application after your official move-out date. You can mail your application with a designated arrival date (配達指定日; haitatsu shiteibi) to do so, but as you require documentation from your home-country bank, most applicants compete the process upon returning home.

Submit an Application for Lump-sum Withdrawal Payments – using this form. Include the following supporting documents:

- Blue Pension Book OR Yellow Basic Pension Number Notice as shown above (original document, make copies prior to applying!)

- Copy of your Passport Data Page (photo, name, signature) and Visa Page(s)

- Official Home Bank Information – a statement, former billing, etc. Must have your bank’s official address/seal and be under your name. Ensure your bank accepts international transfers.

| (if mailing from overseas) Japan Pension Service 3-5-24, Takaido-nishi, Suginami-Ku Tokyo 168-8505 JAPAN | (if mailing from within Japan) 〒168-8505 東京都杉並区高井戸西 3 丁目 5 番 24 号 日本年金機構 (外国業務グループ) |

After Receiving Lump-sum Withdrawal Payment

It will take several months (an average of 6) to receive your 80% Lump-sum Withdrawal Payment. You should receive a physical packet in the mail from the Pension Service around the same time you get the payment into your home bank account.

Now, your Tax Representative Applies For Your Tax Refund (Remaining 20%).

Within your packet from the Pension Office, find and make a copy of the Notice of Entitlement: Your Lump-sum Withdrawal Payments (脱退一時金支給決定通知書; Dattai Ichijikin Shikyū Kettei Tsūchisho). The original should be sent to your Tax Representative in Japan.

Your Tax Representative should mail/take the notice to your local tax office within Japan along with the other documents outlined above that you gave them before leaving Japan. They should file for a Tax Return (確定申告書; Kakutei Shinkokusho)

Note that as of January 2025, regional tax offices no longer return certified copies of submitted documents. PLEASE ensure you make copies before you make your application or give any documents to your tax representative. ONLY send your originals to the Pension Office.

Your Tax Representative should receive the remaining 20% of your Pension Entitlement within 4 months. They will then have to transfer the money to you (via Money Order, GoRemit or Wise, etc.)

Summary of Procedures

Option 2: Transferring the Enrollment Period to Your Home Country

Social security agreements are made to tackle pension-related problems that arise from increasing people-to people exchange. Practically speaking, they aim to stop people from having to pay into more than one pension system and to allow people to transfer their period of coverage to another pension system.

As of January 2014, countries with social security agreements with Japan are Germany, United Kingdom, South Korea, United States of America, Belgium, France, Canada, Australia, Netherlands, Czech Republic, Spain, Ireland, Brazil, Switzerland, and Hungary. However, the agreements with the United Kingdom and South Korea do not have pension enrollment measures in place that would allow you to count your enrollment period in Japan toward your home country’s pension system. Italy and India have signed agreements, but they are not yet being implemented.

For more information about social security agreements, please refer to the Japan Pension Service website.